Factor Endowment Theory of International Trade

Heckscher-Ohlin's

Factor Endowment Theory, Heckscher-Ohlin Model, H-O Model, and Factor

Proportion Theory are several names for this economic and international trade

theory. According to this concept, a country should specialise in and export

goods that relate to its abundant factors of production. Two Swedish

economists, Eli Heckscher in 1919 and Bertil Ohlin in 1933, made significant

contributions to this idea. They proposed various explanations for Ricardo's

theory of comparative cost advantage. This is referred to as the H-O Model. The

H-O model clarifies how different countries' comparative costs differ.

Generally,

factor endowments refer to the richness, abundance, and easy availability of

factors of production (namely land, labor, and capital). This theory suggests

that countries with larger labor forces should focus on labor-intensive

production. As well, a country with a highly capital-intensive economy should

use capital-intensive production methods. According to the theory, elements

with a high relative abundance are less expensive than factors with a low

relative scarcity. It explains the basis of international trade using factor

endowments. Mother Nature bestows a country with a certain number of factors of

production.

If a country had an abundance of labor

relative to land and capital, it would naturally have lower labor costs

compared to land and capital costs (such as rent and interest, respectively).

Conversely, in a situation where there is a scarcity of labor, labor costs

would logically be higher than land and capital expenses. These differing cost

dynamics would lead countries that utilize more affordable and readily

available factors of production to excel in production and export activities.

The Heckscher-Ohlin (H-O) model argues that

differences in the availability of production resources lead to differences in

production costs globally and locally. Heckscher and Ohlin propose that

comparative advantage arises from variations in a country's resource

endowments. While free trade is beneficial, trade patterns are shaped by these

resource differences rather than disparities in productivity levels. According

to factor endowment, countries export products that require a significant

amount of their abundant production factors and import products that require an

abundance of their scarce production factors.

In the H-O model,

international trade occurs as a result of disparities in production costs

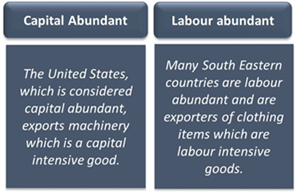

driven by variations in the availability of production factors. For instance,

countries like China, India, Nepal, Bangladesh, and others can export goods

that heavily rely on labor because they have ample labor resources at their

disposal. Nations such as Japan, the USA, the UK, and Germany are exporting

capital-intensive goods like machinery and high-value equipment because they

possess an abundance of capital investment needed for advanced technology and

other infrastructure.

The H-O Model’s assumptions:

1. Different products exhibit distinct factor

intensities, such as textiles and apparel being labor-intensive while

semiconductors are capital-intensive.

2. . Nations possess varying factor endowments;

for instance, Nepal has an abundance of labor relative to capital, while the

USA has more capital relative to labor.

3. The

model involves two countries, two goods, and two factors of production.

4. Both

commodity and factor markets operate under conditions of perfect competition.

5. There are constant returns to factors.

6. Technology is universally available and

consistent across all participants.

7. There are no additional costs like

transportation expenses, insurance premiums, or exchange rate fluctuations.

8. No restrictions or controls are imposed on

international trade and exchange rates.

9. Factors of production are immobile between

countries, and their endowments remain fixed.

10. Demand conditions are assumed to be stable

and unchanging.

In summary, the Heckscher-Ohlin Model,

commonly known as the Factor Endowment Theory, sheds light on global trade

patterns by stressing a nation's factor endowments—its abundance of labour and

capital—as a fundamental predictor of its comparative advantage in various

industries. This causes countries to specialise in industries aligned with

their resource strengths, promoting effective resource allocation and

increasing international trade.

While the theory's assumptions, such as

perfect competition and factor immobility, simplify complex economic dynamics,

they may not account for all factors influencing trade, such as technology,

economies of scale, and government regulations. In practice, international

commerce is the outcome of a combination of factors, and the Factor Endowment

Theory remains a core model for understanding these dynamics, underlining the

importance of a country's resource endowments in shaping its competitiveness.

The Leontief Paradox

Leontief paradox contradicts the

principles of the factor endowment theory. According to this theory, a country

should export goods that align with its abundant factors of production.

However, Wassily Leontief, a US economist, challenged this idea in 1953. It was

commonly believed that the US had an abundance of capital compared to labor,

making it an exporter of capital-intensive goods and an importer of

labor-intensive ones.

However, Leontief's research

discovered cases where the US was exporting labor and skill-intensive products

in exchange for capital-intensive ones, contrary to the predictions of the H-O

Model. This finding became known as "The Leontief Paradox."

Developed countries like the US,

Germany, and Japan, driven by strong incentives for research and development,

produced innovative consumer products and cost-effective processes.

Surprisingly, many of their exported products were not capital-intensive. Conversely,

these countries also imported or traded for capital-intensive items like

machinery and computers from nations such as Taiwan, Poland, and China.

Ashida. A. P, Assistant Professor, Dept. of Commerce, Al Shifa College of Arts and Science, Keezhattur, Perinthalmanna

Comments

Post a Comment